Things to Consider When Financing or Refinancing Your Mortgage

- July 22, 2020

Share this article

As interest rates hit historic lows, you may be thinking about buying a home, upsizing, downsizing, moving locations, or even refinancing to lock in a lower rate. In this segment of our Planning Matters series, we explore what prospective homebuyers and refinancers should consider as they enter today’s real estate market.

Planning Ahead

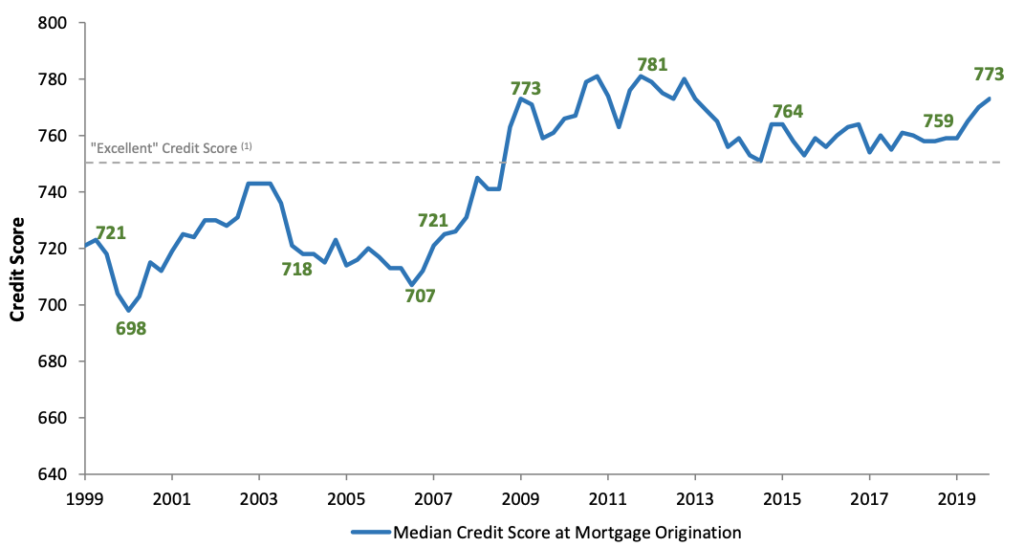

If you are thinking about applying for a mortgage within the next 3 to 6 months, it’s a good idea to run the numbers. The more you know, the more confident you will be in the home buying and refinancing process. Using a free online calculator will help you calculate how much mortgage you can comfortably handle based on the home price and down payment. Keep in mind that the money that you plan to use for your down payment should be somewhere easily accessible (and in a low risk/short term asset class) in case you need quick access to it. After the 2008 Financial Crisis, many banks and institutions tightened their lending standards. Below is a chart of the median credit score of homebuyers at mortgage origination over the last 20 years. Be sure to build up your credit score, as a higher score means lower interest rates. The last step in planning ahead is document gathering. You will save time by making sure you have all the documents you need to start the mortgage process.

Median Credit Score on Mortgage Originations: 1999 to 2020

Getting Pre-Qualified

Although it takes some upfront homework, getting pre-qualified with a mortgage lender can save you time in the long run. Perhaps most importantly, getting a pre-approval will ensure that the price range of homes you are looking at are ones you are financially qualified for. When starting the search for mortgage lenders, start by learning about the lending landscape and current mortgage rates. From there, our team suggests interviewing at least three mortgage lenders and using the research on current mortgage rates that you did to help you negotiate. The most important factors in selecting a mortgage broker are mortgage rates and likeability and reliability of the lender. While getting along with your lender is important, a lower rate has the potential to save you money over the long term.

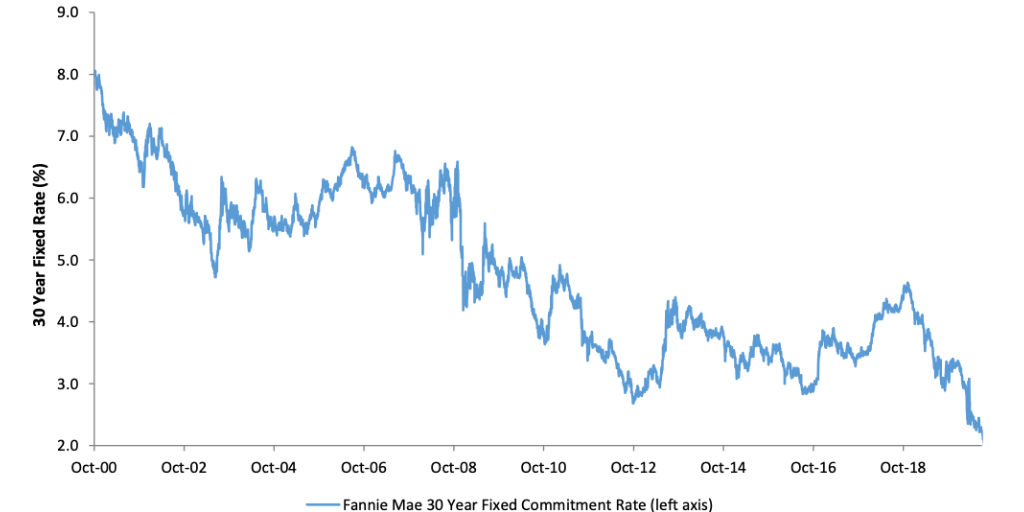

If you have kept up with the news lately you may have seen a plethora of headlines on current mortgage rates. Mortgage rates have hit historic lows in the past few weeks and have been on a steady decline since November 2018. If you are considering refinancing, make sure you understand how much equity you currently have in your home as well as the closing costs associated with a new mortgage.

Fannie Mae 30 Year Fixed Commitment Rate: 2000 to 2020

The Final Stretch

If you are putting an offer in on a new home, don’t be afraid to negotiate boldly. There are only three outcomes if you put in a below–asking offer: the seller(s) will reject it, come back with a counteroffer, or they may even accept it! Our advice is to let your agent handle the negotiations, but don’t be afraid to ask for a lower price.

If you are considering refinancing, we recommend reviewing Bankrate’s key questions to ask before you refinance your mortgage.

For most of us, buying a home is the most important financial decision we will ever make. It’s also an intensely emotional decision. Following these tips can make the process smoother and give you greater confidence. If we can provide more information about real estate, mortgages, interest rates, or anything else, including introductions to mortgage lenders or realtors, please get in touch with us.

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.