I Do, Again

- November 23, 2021

Share this article

Getting Married Again? What does that mean for “our” finances?

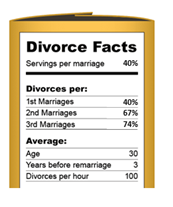

Whether the thought of money makes you feel good, bad, or otherwise, talking about money tends to bring out a lot of “feelings.” In a relationship between two people, those feelings are compounded. Add in a third party (an ex-significant other, a child, a parent, etc.) and all-things-financial can get even trickier. We recently discussed the importance of financial transparency between newlyweds but it turns out that being financially transparent can be even more important with second or third marriages. Available census data shows that while the divorce rate for first marriages is around 40%, the rate of failure for second marriages is around 67% and for third marriages a whopping 74% end in divorce! While finances are certainly not the only reason for these divorces, 41% of marriages do end because of “financial incompatibility.” We know that money matters in first marriages, but add in spousal maintenance payments, child support, stepchildren, etc. and money can quickly become an even more pronounced issue in second or third marriages.

So, what’s a couple to do?

Honesty is the Best Policy

Whether it’s your first relationship or your 100th, interpersonal communication is always key. Start with having some frank conversations about money, your relation to it, your spending habits, and your expectations. Were there conversations you should have had with your Ex that you put off or issues you let fester? Learning from past mistakes can help create realistic expectations for your newly created family. Be honest with yourself if you’re letting biases from prior relationships shade the conversation in your new one. And don’t leave out financial responsibilities tied to your prior marriage, even if you think they’re not your new spouse’s responsibility. After all, you’re on the same team now!

Yours, Mine, and Ours.

There’s no “one size fits all” with what works best for you and your spouse when it comes to combining finances. There’s also nothing that says that you need to combine them completely or keep them fully separate. Rather, it can often work best to do a little of each – create a joint account for shared expenses and separate accounts to maintain a sense of financial freedom. This can be especially helpful in prompting the conversation around what expenses should be shared and which ones shouldn’t. There are no rules that say each spouse only gets to access the money they bring home, as roles and responsibilities differ in each partnership. Perhaps having all the paychecks flow through the joint account and taking an “allowance” for each spouse to their individual accounts make sense.

QTIP Trusts, Prenups, and More.

Estate planning tends to be a complex topic even when you are only considering your wishes and/or biological children. In second marriages, adding more interested parties into the equation can make it infinitely more complicated. However, there’s a wide set of tools available to ensure that your wishes and responsibilities are fulfilled. Wills, prenups, retirement and life insurance beneficiary forms, and trusts can all be tailored to your situation.

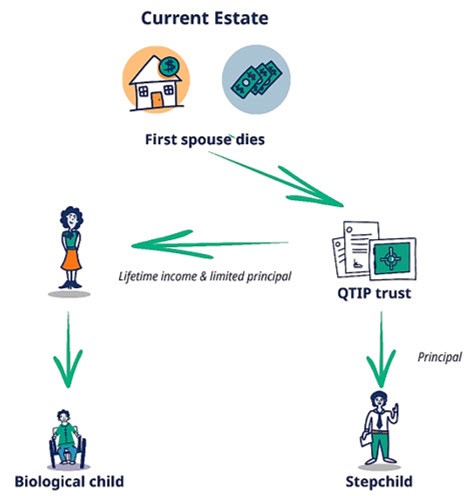

We’ve outlined the benefits of a Trust in estate planning before, but second spouses with disparate assets and children from a prior relationship may wish to think about a more specific type of Trust, a Qualified Terminable Interest Property Trusts (QTIP). A QTIP trust allows the grantor to give a spouse income and access to principal from the Trust for the remainder of the surviving spouse’s life while preserving the estate and marital gift tax deductions. Once the surviving spouse dies, the principal of the trust reverts to the grantor’s heirs (or other, previously specified, surviving beneficiaries). Unlike with revocable lifetime trusts, the surviving spouse has little ability to change beneficiaries. Other types of irrevocable trusts can also be useful for other estate planning goals.

How a QTIP works:

Source: https://memberstrust.com/qtip-trust-protect-your-childs-inheritance/

While no one likes thinking about a divorce right when they’re getting ready to say: “I Do, Forever,” a prenuptial (or post-nuptial) agreement is a smart way to protect your assets in case of a split. Prenups get a bad rep, but especially in second marriages, which are more likely to take place later in life when you have more at stake, it’s critical to think about your finances from a big picture/worst case scenario perspective. Moreover, the Millennial generation, who are getting married later and who also often have high debt balances, have shifted the conception that prenups are only for wealthy individuals looking to protect premarital assets or avoid paying alimony. Rather, they’re finding that prenups can be valuable for most income levels, especially if there’s debt or a previous marriage. If you or your spouse have debts, prenups can help ensure that your debt does not become your spouse’s responsibility in case of divorce. Prenups can be written with a fair amount of flexibility. For instance, if a couple is keeping their finances separate, a prenup can be used to specify whose responsibility it is to pay for a future child’s bat mitzvah or if alimony payments will change depending on how long the marriage lasts. They also can be used to determine what happens to nonfinancial assets, like who gets the frozen embryo or other genetic material, and outline expectations for digital property/social media.2,3

Just like no two couples are identical, no two financial puzzles will be put together in exactly the same way. Ultimately, it’s up to what makes you and your partner most comfortable when merging your pieces to create your full financial picture. Our advice? Address any financial questions, ambiguity, and concerns early on and with honesty and openness. This can not only protect your marriage, but it can also make it stronger. If you’re getting married for the second time and you find yourself searching for answers or advice, please reach out to our team.

Subscribe To Our Newsletter

Sources:

- https://www.wsj.com/articles/youre-getting-married-again-should-you-combine-finances-too-11581994981

- https://tomorrow.me/getting-married/the-beginners-guide-to-prenups/

- https://www.census.gov/content/dam/Census/library/publications/2015/acs/acs-30.pdf

- https://www.survivedivorce.com/second-marriage-divorce

- https://divorcestrategiesgroup.com/why-second-marriages-fail/

- 1. https://www.bgsu.edu/ncfmr/resources/data/family-profiles/payne-median-age-first-marriage-geo-fp-19-07.html , https://www.visualcapitalist.com/american-income-levels-by-age-group

- 2. https://www.prenuppros.com/post/why-are-prenups-popular

- 3. https://www.wsj.com/articles/millennials-embrace-prenupsbut-through-a-very-different-lens-than-in-the-past-1161125203

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.