The Case for Global Diversification

- May 15, 2020

Share this article

When someone chooses to invest solely in companies from their own country over those from other places in the world, it’s called “home country bias.”1 Home country-biased investors are generally optimistic about their domestic market, and pessimistic, indifferent, or uninformed when it comes to foreign markets.

It makes sense why investors might be biased:

- They may be daunted by figuring out the global markets, so they look to the place they know best: their home market.

- They’re more familiar with domestic brands, which makes their value more upfront and evident. Trusting the steadfastness of their performance comes much easier.

- There could be tax benefits for prioritizing an investment close to home.

It’s understandable that investors might be hesitant to invest abroad — but in doing so, they’re missing out on enormous investment opportunities and prospects for growth.

Recent Performance is Not a Reliable Indicator of Future Returns

It may feel like United States (US) stocks have outperformed international and emerging-markets stocks over the past several years. But that doesn’t mean you shouldn’t invest outside the US. Here’s why:

1. Stock performance is random across different aspects of the world.

There is no reliable evidence that a country’s performance can be predicted in advance. Some countries may seem like better investments than others based on how their economies and stock markets are doing currently, but remember — they fluctuate in performance from year to year.

2. Non-US stocks help provide valuable diversification benefits.

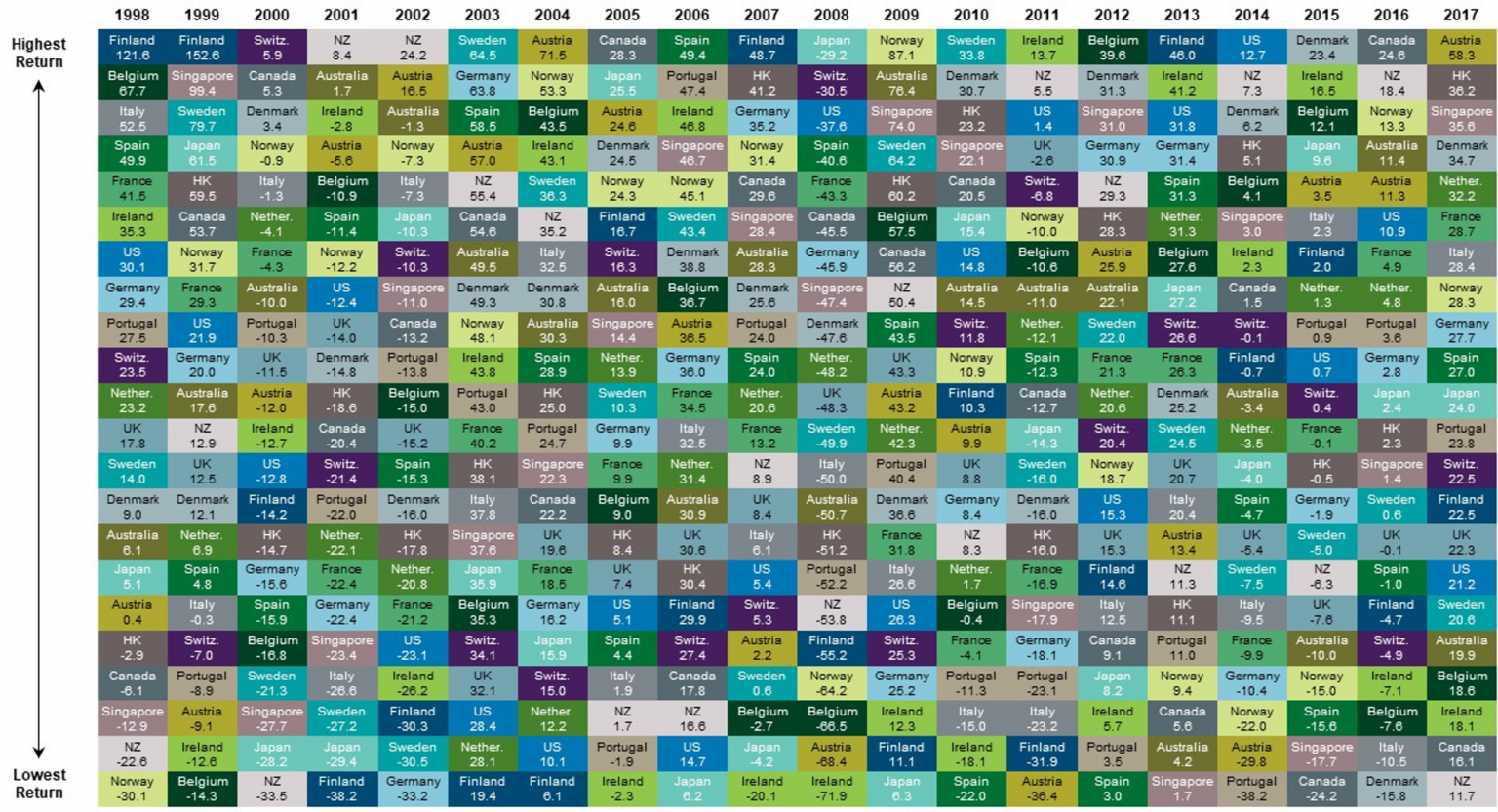

The following graphic illustrates 20 years of annual equity returns for developed markets, with each column sorted from the highest-performing country to the lowest. The quilted, colorful pattern demonstrates the randomness of returns, with no country following any distinct pattern or placement in the ranking over time. The US, for example, was the top-performing country only one out of the last 20 years (2014).

In US Dollars

Source: MSCI country indices (net dividends) for each country listed. Does not include Israel, which MSCI classified as an emerging market prior to May 2010. MSCI data © MSCI 2018, all rights reserved. Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

The Importance of Diversification

We all know that global equity returns are random. But that isn’t something to be feared, and you shouldn’t try to guess which country is going to outperform when. If you have a well-structured, globally diversified portfolio, you are better positioned to capture the performance of the global markets, where and when it occurs. A well-diversified, global portfolio delivers more reliable outcomes over time, helping you stay on track, through all kinds of markets, toward your long-term goals.

Diversify Your Portfolio Today

As of 2017, the US accounted for 52% of the world’s market capitalization, meaning that almost half of the world’s equity investment opportunities lie outside of the US. Failing to diversify is a distinct portfolio weakness. For one, it leaves you at risk in the case of a domestic economic decline, and it also keeps you out of the mix for tremendous internationally-based investment opportunities.

Investment opportunities exist all around the globe. Across more than 40 countries, there are over 15,000 publicly traded companies.2 Don’t miss out on all that the global markets have to offer.

Are you a financial advisor who is interested in growing their business, or an investor who is looking for wealth management advice? Treehouse Wealth is here to help. Contact our team today.

Subscribe To Our Newsletter

Sources:

1. Definition of “home country bias,” James Chen, Investopedia, June 7, 2018, https://www.investopedia.com/terms/h/home-country-bias.asp, accessed January 2020.

2. Number of countries and publicly traded companies data provided by Bloomberg.

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.